Inflation is running hot! Prices have climbed for everything from cars to food to gasoline. These increases and others caused the Consumer Price Index (CPI) to rise 5% or more during the past three months, which is the most since the summer of 2008. Even if you don’t follow the economy closely you should pay attention to this. Inflation can erode the purchasing power of your money and affect your long-term financial plans. In this Investment Thoughts, we will discuss various elements of inflation. We will also explain how we have positioned portfolios to help protect you if inflation rises faster than expected.

In the wake of the global pandemic and the disruptions it created, the outlook for inflation is particularly uncertain. Although we expect price pressures to cool from current levels, there is a good chance inflation will remain elevated for longer than many investors expect. Here are some of the key factors that will influence the inflation rate in the future.

Why Inflation May Ease From Current Levels

The “base effect” will fade. Today’s inflation percentages appear high partly because last year's inflation numbers were very low due to the Covid-induced economic freeze. As those large differentials drop out of the calculations, inflation percentages should come down.

Economic growth will slow. Although the economy will remain strong, its rate of growth will peak soon. It will decelerate as pent-up demand from the Covid-19 lockdown subsides and emergency policies that boosted the economy over the past year wane. Because inflation follows economic growth with a lag, it should also decelerate in the months ahead.

Supply shortages will diminish. Bottlenecks in the global supply chain have contributed to rising inflation. During the pandemic demand for goods and services dropped sharply. Companies responded by idling factories and laying off workers. The economy has since rebounded and manufacturers are now struggling to rehire workers and find the components they need to produce products. This has led to delivery delays and price increases. These imbalances will diminish as supply catches up to demand, but it won’t happen overnight. Given the complexity of semiconductor manufacturing, for example, it will take time to ramp up chip production. The shortage of semiconductors has held back the production of goods such as automobiles, appliances and smartphones.

Why Inflation May Stay Elevated

Wages are likely to increase. Wages are rising and may increase further as businesses struggle to find workers. America had a record 10.1 million job openings in June. Employers are offering incentives to attract workers such as cash bonuses, tuition support, childcare and even pet insurance. It should become easier to fill positions as generous state-level unemployment benefits expire, schools reopen for in-person instruction and the Delta variant recedes. But companies may still need to raise wages to attract workers as the labor market tightens. The pandemic precipitated structural changes and there are many workers that may never return to their old jobs.

Housing costs accelerate. Although home prices are red-hot, they are not directly factored into the Consumer Price Index. Instead, the Bureau of Labor Statistics includes “owners’ equivalent rent” in the CPI calculation. This measure accounts for about a quarter of the index. It is how much homeowners think they could ask for if they rented their homes. Homeowners are always slow to adjust their expectations. Therefore, this hypothetical measure usually lags home price increases and actual rents, which private sector reports show are rising in the double digits. As the Bureau’s statistics catch up to reality, it will likely be a source of persistent upward pressure on the Consumer Price Index.

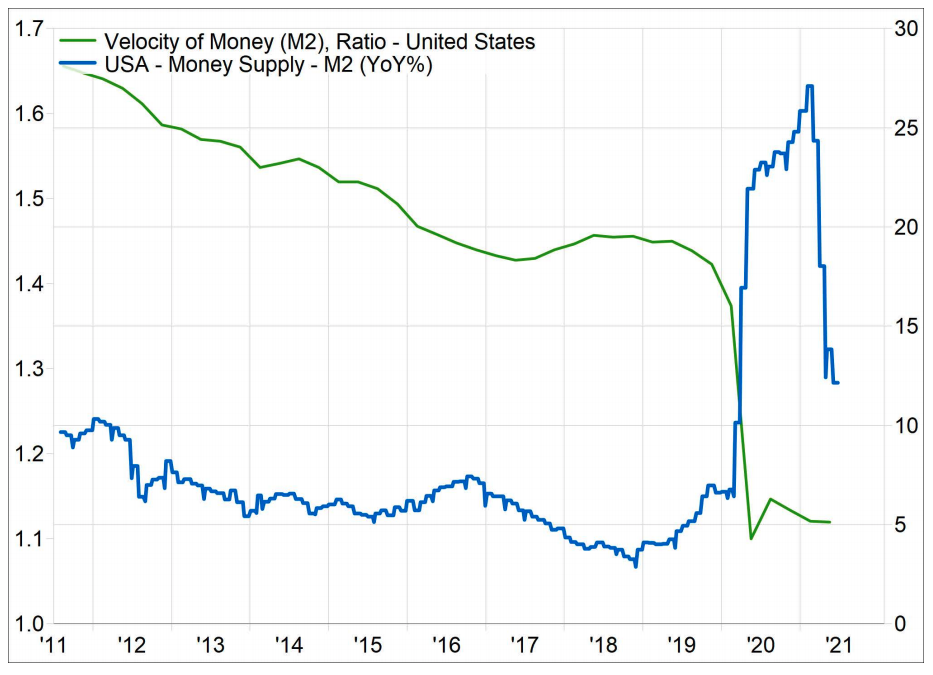

The Fed keeps its foot on the accelerator too long. Inflation could get out of hand if the Federal Reserve does not take steps to reverse some of its ultra-easy monetary policies soon. The textbook cause of inflation is too much money chasing after too few goods. We are experiencing both conditions today. When Covid-19 became a global issue, the Federal Reserve supported the economy by flooding the capital markets with trillions worth of liquidity. As the following chart shows, M2 money supply (blue line) surged an unprecedented 25%! Meanwhile supply bottlenecks have constrained the production of goods. While this situation is concerning, we take some solace in the fact that the velocity of money declined and remains low. The velocity of money is the rate at which money is exchanged in the economy. It is shown by the green line. When it is low, it helps neutralize the inflationary impact of strong money growth. Still, The Federal Reserve needs to begin to unwind its emergency policies soon to ensure that inflation does not become a persistent problem.

Inflation expectations rise. If companies and consumers begin to expect inflation to rise it can become a self-fulfilling prophecy that causes actual inflation to rise. If companies believe inflation will keep rising, they will pass higher costs on to the consumer. Faced with higher costs at the cash register, consumers will ask their employers for higher pay. This cycle can become self-perpetuating. Recent surveys show that inflation expectations are rising but are still well contained. That could change, particularly if people lose confidence in the Federal Reserve’s ability to keep inflation under control.

What We Are Doing About It

Given all these moving parts it is hard to know how inflation will play out in the months ahead. History shows that economists have a very poor track record forecasting inflation and the pandemic has made the outlook more uncertain than ever. While it is hard to predict inflation, we can prepare. We have put a lot of thought into how to construct portfolios for a period when inflation may prove more persistent than many people currently expect. We believe the following features of our portfolios are helpful:

We are holding more bonds with short-term maturities than usual. Short-term bonds decline less in value than long-term bonds when inflation picks up and interest rates rise. We also hold Treasury Inflation Protected securities (TIPS) in portfolios that hold taxable bonds, except for those that have a high allocation to stocks. Unlike traditional bonds, their principal value and income adjust higher as inflation increases.

We also hold certain types of stocks that have historically outperformed the market during periods of rising inflation. As we discussed in our October 2020 Investment Thoughts, we have increased our clients’ exposure to high quality value stocks over the past year. A recent study by GMO, a prominent Boston based institutional investment firm, looked at the performance of high-quality value stocks during periods when inflation was more than 5%. They found that they exceeded the S&P 500 Index return in 7 of 8 of these periods. During higher inflation environments investors tend to rotate away from growth stocks and into value stocks as current income and cash flows become more important. Growth stocks’ promises of higher profits in the distant future look less attractive in an inflationary environment. We are also focused on holding stock in companies that can pass on higher costs to their customers by increasing prices.

Over the past year we have also added more international investments to portfolios. They have more exposure than the US market to sectors that benefit when inflation is rising. International stocks also provide exposure to currencies other than the US dollar. This can be helpful during inflationary periods when the dollar often declines in value.

A dollar today does not equal a dollar tomorrow when there is inflation and that can affect your financial plans. Therefore, it is important to factor in inflation when developing a sound financial plan. If you are concerned about the long-term impact of inflation on your finances, I encourage you to contact your Ledyard team. We can run different scenarios to explore how inflation might impact your unique financial situation. We can also suggest adjustments to help you be better prepared if inflation persists.

As always, I welcome your thoughts or questions. Enjoy the rest of the summer!

Douglas B. Phillips, CFA

Douglas B. Phillips, CFA

Chief Investment Officer

douglas.phillips@ledyardbank.com

(603) 640-2726

This communication is intended to be strictly informational. Exclusive of our client relationships, it is not intended to be, nor does it constitute an offer to sell or a solicitation of an offer to buy any securities referenced. Information contained herein has been obtained from sources that are believed to be reliable, but its accuracy and completeness cannot be warranted or guaranteed.

Non-deposit investment products are not insured by the FDIC, are not deposit or other obligations of, or guaranteed by the bank or any affiliate, and are subject to investment risk including the possible loss of principle amount invested.

Ledyard National Bank. All rights reserved.