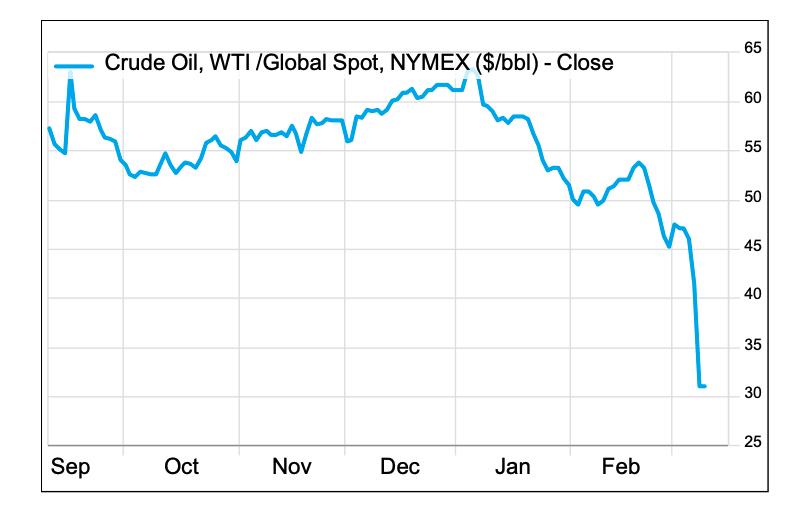

Oil, boil, toil and trouble; a witch’s brew in the global oil and gas markets has been provoked by Saudi Arabia after a failure amongst OPEC members and Russia to agree production cuts to stem weak oil prices. Russia, who is in the grip of U.S. economic sanctions, has refused to make cuts in their oil output. With no agreement, Saudi has recklessly announced damaging price cuts to the oil they are selling, promising to increase production to 12.3 million barrels a day, presumably with the goal of maintaining market share. This sent oil prices reeling, as shown in the chart below.

This conflict is being described as a price war with Russia, but we think it is really at the expense of US shale oil producers. US shale production is about equal to Saudi’s production today and has displaced Saudi barrels in the market. Saudi’s threatened supply hike is more than 25% above their last month production. This supply shock occurring at the same time as the coronavirus threatens economic demand for oil and is a double blow to markets. This is not likely sustainable or even reachable without the Saudi’s tapping into inventories from storage.

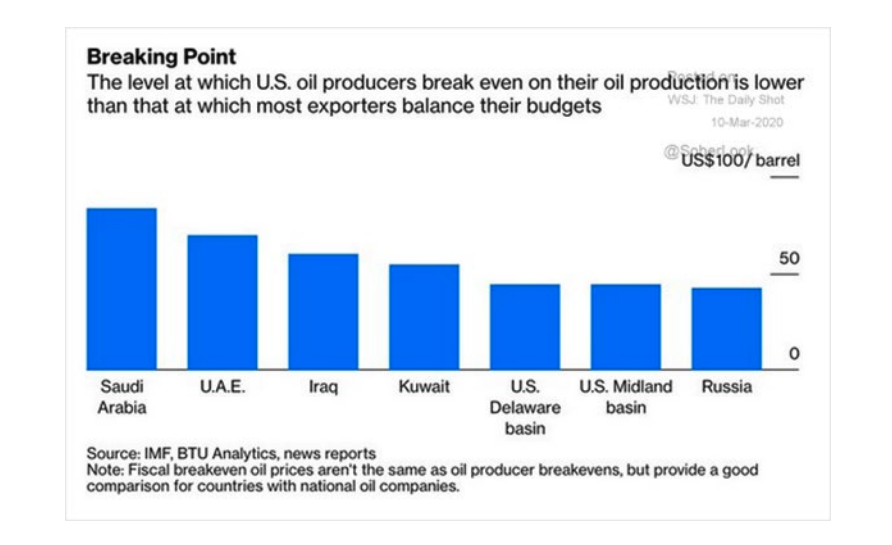

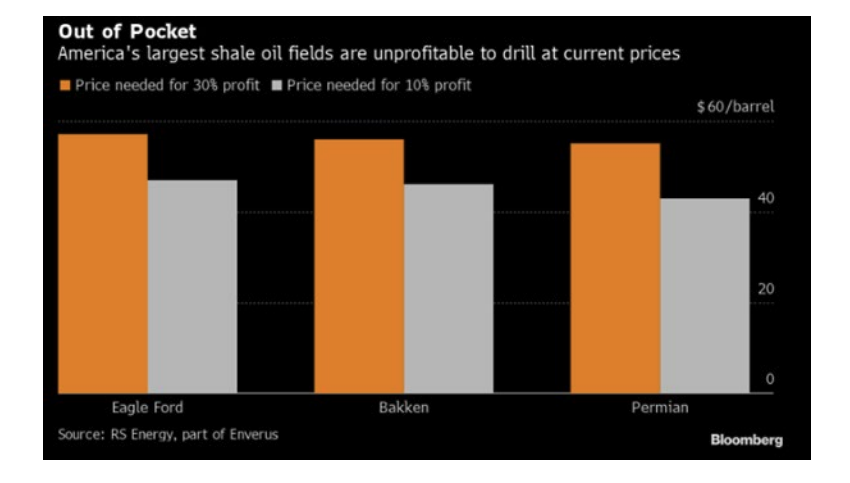

For American shale producers the rout in oil prices is a game changer and in some cases “life threatening” to those companies with large amounts of debt financing. Cash flows could collapse and marginal producers would fail. With the development of shale oil in the US, we have been a net exporter of oil. In fact, with oil in over-supply in the US, it is necessary to export the oil to receive the higher European Brent oil price compared to the domestic West Texas Intermediate price (WTI). How will this battle shake out? If one wants to see this in Russian vs. Saudi terms, Russia is in better financial shape with larger cash reserves and less debt than Saudi with its $50bn budget deficit and massive domestic social spending. Russia’s costs are in Rubles and the Ruble is highly correlated to oil. Weak oil prices lower the Ruble price of operations. If the low oil price from excess production should be prolonged, we give odds to Russia to withstand the pain. Other members of OPEC like Algeria hope for another workaround and a truce. Every oil producer has a needed price so they can break even on cost. Importantly, US shale needs $50-$60 oil to make a profit as is be noted in the tables below.

While the bust in oil prices will hurt some companies and countries that depend heavily on oil sales, it will provide stimulus to many parts of the global economy. One of the bigger winners is China, an oil importer and the world’s second largest economy. As they work to contain the virus outbreak and offset the loss of manufacturing volumes, a lower oil price is welcome. For American consumers the price cut is unambiguously positive and will mean lower gasoline and heating/cooling costs, much like a tax cut. Amazon, FedEx and UPS and the airlines are beneficiaries as well.

The American shale producers may need to be consolidated into larger oil companies if price weakness persists either from the price war or from weakened final demand due to the US economy hurt by the virus dislocations. There are only a few larger companies that can make money in the shale at current prices, Exxon and Chevron for example. The S&P 500 Energy Index is down -44% YTD and will likely prompt large companies that did not have shale production to use this dislocation as an opportunity. These high quality integrated energy stocks will thus, be able to strengthen their competitive position. After steep declines, they are on sale, in some cases below 2009 prices.

It is worth noting that the energy sector is now at a record-low percentage of the S&P 500 Index market cap which should limit the damage. Stress in the energy patch will, however, have an impact on certain segments of the fixed income markets. We are monitoring this closely.

Saudi’s decision to launch a price war came at a time when investors were already on edge given the uncertainty surrounding the coronavirus. This caused another wave of extreme market volatility that would not have occurred if this event happened in isolation. We do not believe current oil prices are sustainable given the pain they will inflict on the Saudi and Russian economies, but it is highly uncertain how long it will take for more rational conditions to return. In the interim, low oil prices have some benefits. We wanted to reach out to you with our thoughts about this event which are more nuanced than was the market reaction to the news.

J.T. Underwood

J.T. Underwood

Senior Portfolio Manager

J.T.Underwood@Ledyardbank.com

This communication is intended to be strictly informational. Exclusive of our client relationships, it is not intended to be, nor does it constitute an offer to sell or a solicitation of an offer to buy any securities referenced. Information contained herein has been obtained from sources that are believed to be reliable, but its accuracy and completeness cannot be warranted or guaranteed.

Non-deposit investment products are not insured by the FDIC, are not deposit or other obligations of, or guaranteed by the bank or any affiliate, and are subject to investment risk including the possible loss of principle amount invested.

Ledyard National Bank. All rights reserved.