The world’s stock markets have made a remarkable recovery after the sharp COVID-19 induced downturn earlier this year. Although uncertainty remains high, many investors have decided to view the glass as half full. They believe unprecedented monetary and fiscal stimulus will provide a bridge for households and businesses to cross to a more benign environment in 2021. The probability has increased that a vaccine will be available then. Several vaccine candidates have shown promising initial results and have advanced to the next stage of testing.

The U.S. stock market has led the global recovery, as it did the last bull market, and is now back near an all-time high. U.S. bond prices have also increased as yields have dropped to record lows. After such a strong run it is likely that balanced portfolios (those that hold a mix of U.S. stocks and bonds) will produce lower returns in the decade ahead. This is a problem for investors because it will be harder for them to meet their financial objectives. We believe investing in international stocks will enhance returns and be part of the solution to this problem.

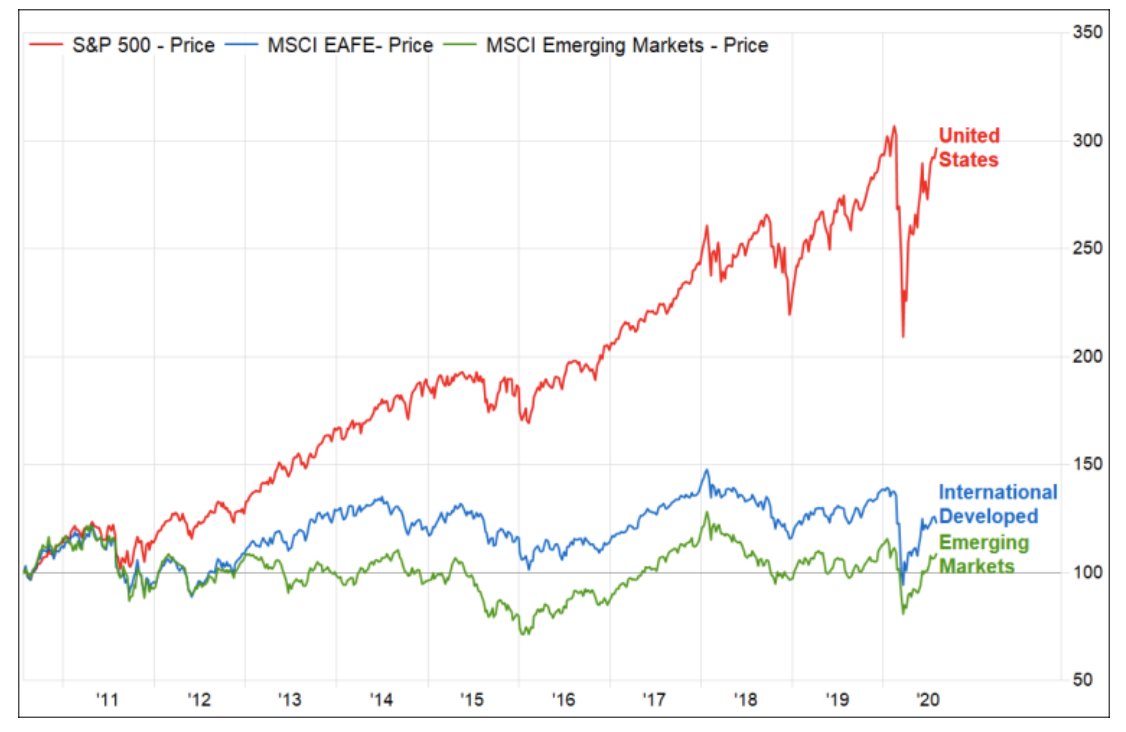

As the following chart shows, U.S. stock market performance has trounced that of the international markets over the past 10 years. As a result, many investors are not enthusiastic about investing overseas right now. This is understandable because we are all prone to recency bias. It is the tendency to believe what occurred in the recent past will continue to occur in the future.

Source: Factset

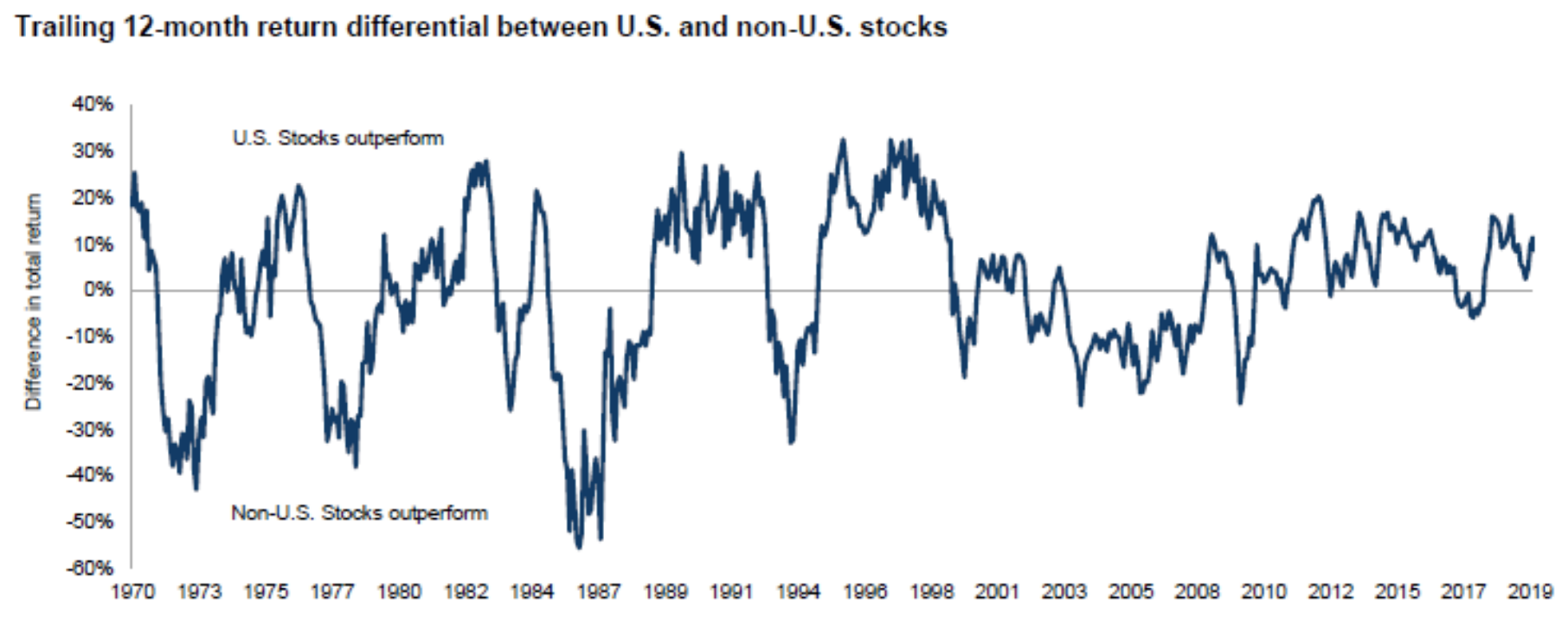

History shows that U.S. stocks do not always sit atop the world’s performance standings. The following chart plots the 12-month difference in returns between U.S. and international stocks going back to 1970. It illustrates that the relative performance of these regions has traded places in the past. These cycles generally last several years. There is no reason why this pattern should not continue in the future. International stocks are likely to take the lead again, but we don’t know exactly when this will happen.

Source: Vanguard

What we do know is that when these cycles turn, they generally catch investors by surprise. Periods of strong relative performance tend to begin when things look bad, not good, and often end when the future seems brightest. As the famous investor John Templeton put it, “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” The last time international markets lagged the U.S. market by such a wide margin was in the late 1990s. Back then, investors were euphoric about the adoption of the Internet. They cast aside time-tested valuation measures and bid up the prices of U.S. dotcom and technology stocks to the stratosphere. Meanwhile, investors were pessimistic about international stocks. They had seen two crises in a short span - the Asian Debt Crisis and the Russian Debt Default. This set up a reversal in fortune that surprised investors. In the 2000s, U.S. stocks posted negative annualized returns while international stocks rose as pessimism faded. Emerging markets outpaced U.S. stocks by more than 10 percentage points on an annualized basis.

It is counterintuitive that investor pessimism precedes better performance. There is a good explanation for this. Investors’ assessment about recent developments, although often legitimate, get priced into the markets. The current list of concerns about the international markets is long. Brexit has been a fiasco. The European Union had been notorious for its fractured decision making and lack of coordinated policy. The Chinese economy is slowing. The trade war hurts countries that export to the United States. Investors have been anxious about these issues for some time. As a result, many of these concerns are already reflected in the price of these markets. As such, these markets don’t need great headlines to move higher, news just needs to be better than expected.

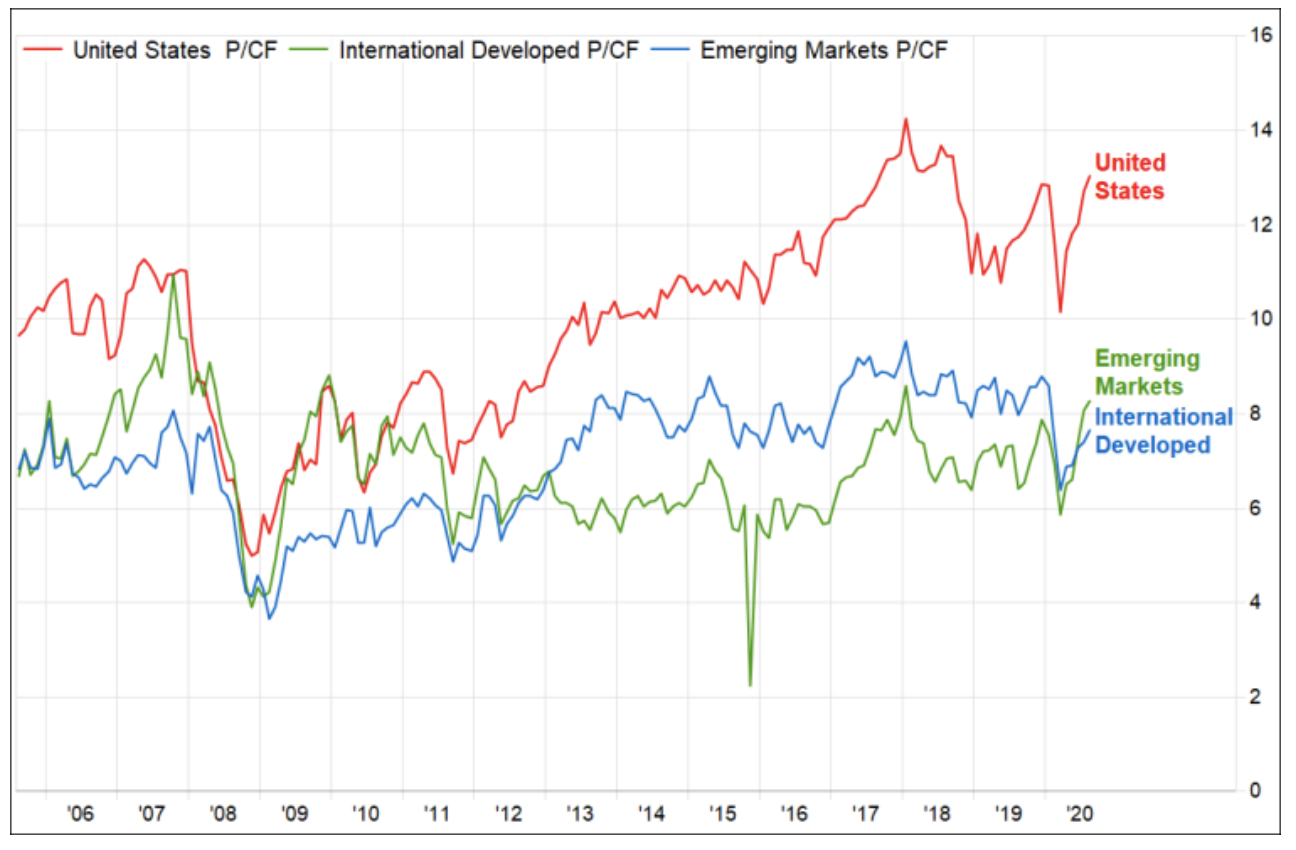

The best way to gauge how much pessimism or optimism is priced into a market is to compare its price to measures of fundamental value. Examples of such measures include earnings, cash flow or book value. The following chart shows price-to-cash flow ratios of the U.S., developed international and emerging equity markets. This ratio divides the price of these markets by the cash flow produced by their companies in each market over the last 12 months. We like this measure because it is harder for companies to manipulate than earnings. It is also not as affected by inconsistent accounting methods in different countries. It shows that investors are willing to pay roughly twice as much for a dollar of U.S. cash flow today than they did 10 years ago. They are also willing to pay over 50% more for a dollar of U.S. cash flow (12X) than they will for a dollar of international cash flow (8X). This U.S. premium is much higher than it was in the past. Other valuation measures tell the same story. International markets are relatively inexpensive. This is because expectations are low.

Source: Factset

Research from Vanguard shows that low valuations – that result from investors’ concerns - lead to higher long-term returns. While valuation levels are a reliable predictor of forward 10-year returns, the rub is that they are a poor short-term timing tool. This is because markets can stay expensive or inexpensive longer than you think. Ben Graham, explained why this is the case decades ago when he said, “In the short term the markets are a voting machine, in the long term they are a weighing machine.” Because many investors are impatient, they are reluctant to rely on long-term historical data for direction. Instead, they invest in popular investments that have already performed well. As the cycle turns and out of favor investments start to climb the proverbial wall of worry, they often get caught at its base.

It is impossible to know exactly when the relative performance of international markets may improve. There are some catalysts developing that might give them a boost. Many European and Asian countries have done a better job containing COVID-19 than the U.S. This will allow these economies to continue to recover. Meanwhile, a resurgence in new infections in the U.S. has caused economic momentum to wane in recent weeks.

The European Union recently approved an ambitious €750 billion stimulus package. It represents a fundamental change in Europe’s approach. They will issue joint debt backed by the European budget and distribute the proceeds based on need. This will provide relief to countries in the south that are struggling, like Italy, Spain and Greece. In the past, wealthier countries were reluctant to help weaker countries. Policies lacked coordination and undermined the path to sustainable recovery. The EU’s failure to have a fiscal union was a justification for why the European markets deserved to trade at a significant discount to the U.S. market. It stands to reason that this discount should narrow now that the EU has demonstrated its commitment to multilateralism.

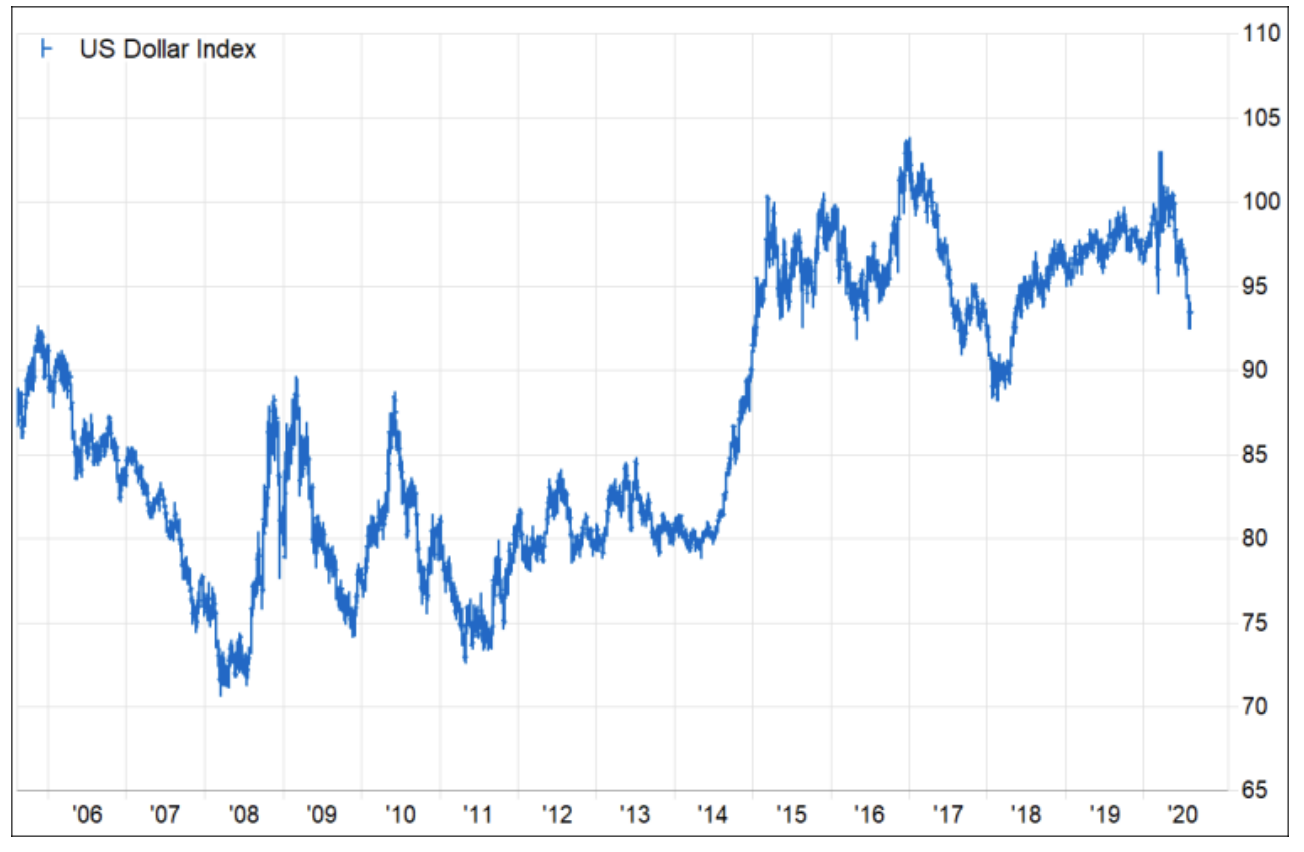

As the following chart shows, the strong dollar has been a headwind for U.S. investors investing abroad for over nine years. This may be changing as the U.S. dollar has started to decline relative to many currencies. When the exchange rate between the U.S. dollar and other currencies declines, it can increase the return on international investments. Concerns about new infections in the U.S. and optimism about the European Recovery Fund may be reasons for recent dollar weakness. Narrowing interest rate differentials and the fact that the U.S. dollar is expensive on a purchasing power basis may also play a role. There are also concerns about the rising budget deficit and debt levels in the U.S.

Source: Factset

We select international investments for our clients carefully. These investments may vary depending on their investment strategy. We make these investments in several ways. Sometimes we use exchange traded funds (ETFs). They track an index that provides broad or targeted exposure to baskets of international stocks. ETFs are beneficial to our clients because they are low cost and tax efficient. For more information, please see our Investment Thoughts titled “How we Build Better Portfolios with Exchange Traded Funds.” We also use mutual funds when their management has an edge and can add value through superior performance or risk management. These managers have a lot of experience and resources devoted to markets outside the United States. We also hold stock in some high-quality international companies. We have a Global Strategy for clients that desire more exposure to international markets (about 50%).

George Santayana, the Spanish-American philosopher, said, “A man’s feet should be planted in his country, but his eyes should survey the world.” Although these words are more than a century old, they seem apropos today as we seek a solution to a problem our clients may face in the decade ahead. Our survey of the world reveals that the foundation is in place for better relative performance from markets abroad. While U.S. investments will remain a foothold in our portfolios, adding exposure to international markets makes sense. They improve diversification and increase the odds of success as we do what is most important - help our clients plan well so they can live well.

Douglas B. Phillips, CFA

Douglas B. Phillips, CFA

Chief Investment Officer

douglas.phillips@ledyardbank.com

This communication is intended to be strictly informational. Exclusive of our client relationships, it is not intended to be, nor does it constitute an offer to sell or a solicitation of an offer to buy any securities referenced. Information contained herein has been obtained from sources that are believed to be reliable, but its accuracy and completeness cannot be warranted or guaranteed.

Non-deposit investment products are not insured by the FDIC, are not deposit or other obligations of, or guaranteed by the bank or any affiliate, and are subject to investment risk including the possible loss of principle amount invested.

Ledyard National Bank. All rights reserved.