On Thursday, Russian President Vladimir Putin launched a wide-ranging military invasion of Ukraine. Attacks and explosions have been reported throughout the country, including the capital, Kyiv. Market volatility has increased significantly as investors grapple with the potential implications of the largest war in Europe in over 75 years.

The situation is fluid, making it difficult to judge the impact of this conflict on the world economy and financial markets. We have been in close contact with our network of research providers that specialize in geopolitical strategy. They are helping us sort through the potential implications of this conflict. As always, we are focused on how these developments will impact your investments. While there is more work for us to do, we would like to share some initial thoughts.

In recent broadcasts, Russian President Vladimir Putin made numerous dubious claims about Ukraine and its relations with the West. He believes Ukraine is an illegitimate country that should be part of the Russian empire. He also views NATO’s move eastward and Ukraine’s ties to the West as a threat to Russia’s sphere of regional influence. His intention appears to put in place a Russian-led government and redraw borders in a quest to revive the Soviet Union.

Russia’s Ties to the World are Complicated

Russia’s relevance to financial markets is ambiguous. It is the largest country in the world by landmass, holds the most nuclear warheads, and is a major energy exporter. At the same time, Russia’s financial footprint is surprisingly small. The country accounts for 3% of the world’s Gross Domestic Product, half that of California. Its stock market is less than half a percent of the world’s total stock market capitalization.

Our initial assessment is the Russia-Ukraine war is unlikely to derail the global economy. Supply chain disruptions, sanctions, and higher energy prices will impact some regions more than others. Any direct effects on the US economy should be very limited because Russia and Ukraine combine to account for well under 1% of US imports and exports. Europe has closer ties to Russia and will face some stiffer headwinds. We do not believe investors should abandon investments in Europe.

Supply-side bottlenecks have been a major challenge since the pandemic hit. This geopolitical crisis will exacerbate these problems and increase prices. The most immediate impact will be on energy prices due to Europe’s heavy dependence on the Russian gas supply. Europe has two weeks of natural gas inventory. The U.S. could supply Europe with liquified natural gas (LNG) but it would take time to reroute supplies. This conflict will likely accelerate the shift from fossil fuels to alternative energy. The world does not want to be dependent on unstable autocrats for its energy supply. Russia and Ukraine export other commodities. Grains, fertilizer and metal prices will experience temporary price increases.

The Russia-Ukraine war may increase inflation in the near term, but central banks may tighten monetary policy at a slower pace than investors currently expect. Markets would view this favorably. Investors currently believe the Federal Reserve will increase the Federal Funds rate seven times in 2022. While the Fed is still likely to raise rates in March, they may not need to raise rates seven times. Central banks understand that past oil shocks have been a drag on economic growth. High energy prices incentivize more production. These factors cause energy prices to fall. Inflation is already set to moderate as base effects fade. They also will not want to shock a market that is already experiencing significant volatility.

Stepping Back for Perspective

Late last year we highlighted the following key themes and risks. We have reassessed our outlook in light of recent developments. Although one of the key risks we identified has come to pass (Russia invaded Ukraine), we do not yet see any reason to make significant changes to the other themes or our outlook. We expect market volatility to stay elevated. It will be important to stay the course, remain diversified, and focus on high-quality assets that offer growth at a reasonable price.

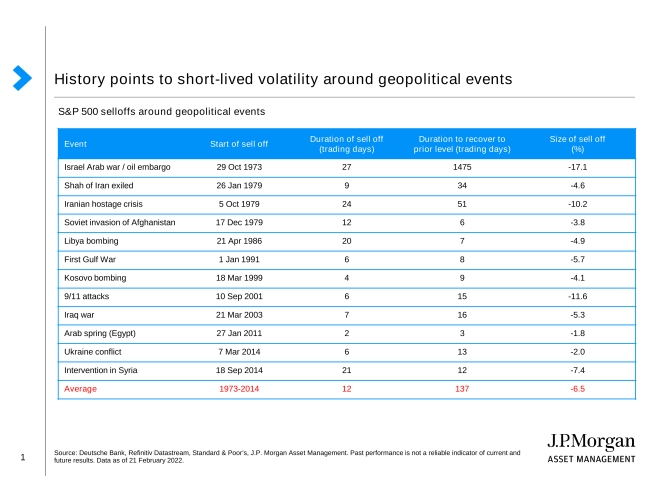

Geopolitical risks are always a wildcard in investing. Events like this are unnerving as they often lead to sharp market declines. Faced with uncertainty, some investors are quick to sell assets and wait for things to calm down. Unfortunately, research shows that such emotionally-driven decisions are counterproductive. Below is a table put together by JP Morgan. It shows that many of the sell-offs in the market due to geopolitical events tend to be short-lived.

Russia will almost certainly win the territorial war with Ukraine given the size and strength of its military. But as Martin Luther King Jr. said, “war is a poor chisel to carve out tomorrow.” Putin’s war on Ukraine will never revive the Soviet Union nor will it advance the interest of Russia. Attempting to occupy a large country like Ukraine will drain Russia’s resources. The West will inflict significant economic damage on Russia and the country will emerge isolated and poorer. The Russian people understand this and that is why many Russians have taken to the streets to protest this war. I feel for them. My thoughts and prayers also go out to the 40 million people of Ukraine. This war will result in a catastrophic loss of life.

We are here for you. If you have any questions about our investment strategy or your portfolios, please don’t hesitate to contact me or any member of your wealth management team.

Doug Phillips

Chief Investment Officer

douglas.phillips@ledyardbank.com

(603) 640-2726