Stocks tumbled in March and made a partial recovery in April as the coronavirus spread and investors reduced their expectations for the economy and corporate earnings. With so much ominous news in the headlines, some may not have noticed that the bond market bounced around much more than normal. This volatility was unusual because bonds typically don’t move around much. It is also worth noting because the bond market plays a crucial role in the financial system. A well‐functioning bond market provides cash flow and liquidity that allow companies and governments to operate. It is the fresh water plumbing system that keeps the global economy nourished. When it becomes leaky or blockages develop, it is a sign that bigger problems may be at hand. We would like to share our thoughts with you about this, because bonds are an important part of most client portfolios.

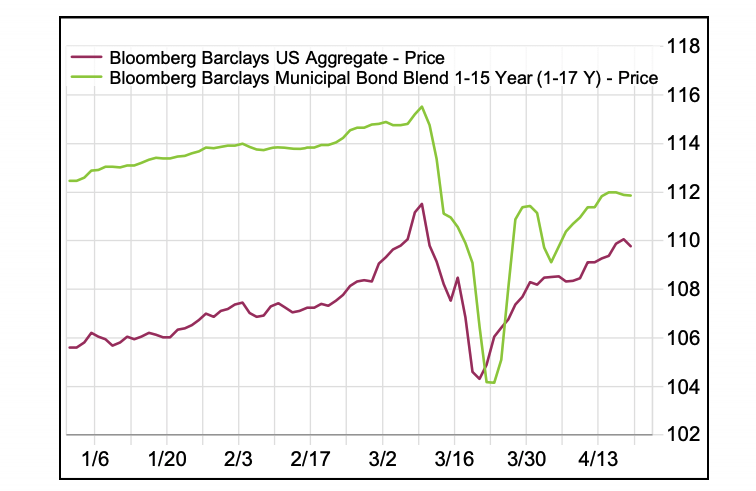

Of course, not all bonds are alike. Bonds with higher yields tend to be riskier. We were not surprised when these types of bonds sold off. High yield corporate bonds, for example, fell over 20%. Investors sometimes call them “junk” bonds because they have credit ratings below investment grade. They can get hit hard when uncertainty about the economic outlook increases. What was unusual was that safer bonds – those that have higher‐grade ratings and usually provide stability and diversification – also declined in value. As shown below, the price of the Bloomberg Barclays US Aggregate index and Municipal Bond index declined 7% and 10% respectively in two weeks. These indices hold better quality bonds with average credit ratings of AA.

The bond market declined because there was a "dash to cash" due to pervasive uncertainty about the economic outlook. The drop in oil prices also created volatility among bonds and other loans in the energy industry. The breakneck speed of this decline had an unpredictable and cascading effect on many other segments of the bond market. For example, corporations drew down their credit lines with banks to raise cash. This forced banks to sell a significant percentage of their municipal bond holdings so that they could meet the demands of these clients. All types of investors panicked at the same time, flooding the market with orders to sell all kinds of bonds. Bond market liquidity was insufficient to handle these orders. Many Wall Street trading desks were thinly staffed due to social distancing requirements. More importantly, new financial regulations since the 2008‐2009 crisis had unintended consequences. Today, bank and brokerage trading desks are less willing and able to hold inventories of securities and take the other side of trades. This made it nearly impossible to sell low quality bonds so investors sold what they could, their higher quality holdings. The market is not supposed to work this way.

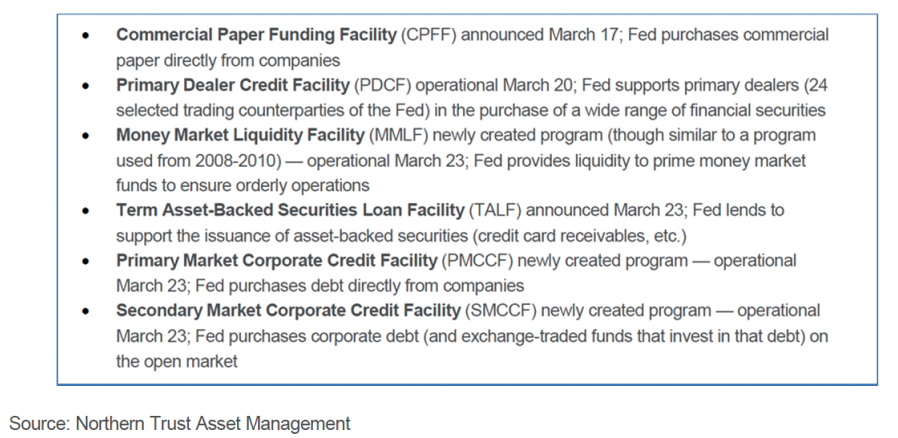

As the lender of last resort, The US Federal Reserve or “Fed” promotes financial stability by providing liquidity in times of panic. In a sense, it is the master plumber of the financial markets. The Fed acted quickly since the crisis erupted to reduce short‐term interest rates to zero. As shown below, they also introduced an alphabet soup of programs to shore up the system and get it flowing again. The Fed is expanding its balance sheet by buying bonds in many sectors. These purchases include Treasuries, agency mortgage backed securities, commercial paper, investment grade corporate bonds and debt issued by state and local governments. They are even buying “fallen angels.” These bonds have fallen from investment grade to junk bond status. While some of these actions may have negative long‐term implications (a topic for a future Investment Thoughts), they have helped calm the markets. Liquidity conditions and performance have improved in many segments of the bond market.

We had reduced exposure to higher yielding riskier types of bond funds before the coronavirus showed up for an unrelated reason. The economic cycle was over 10 years old, making it the longest in history. Cycles sometimes last longer than expected but they never last forever. We knew that when they end, riskier bonds do not fare well. Clearly, we had no idea that the economic cycle would end so abruptly – via a devastating pandemic that would bring the global economy to its knees. But that is the nature of cycles. They often end for unforeseeable reasons. Now that the bond market offers better value than it did a few months ago, and the Fed has shored up the plumbing, some clients have asked us if we plan to change our fixed income strategy.

We are fortunate because in addition to our strategy and portfolio management team’s experience, we are able to tap into the expertise of several specialized firms that have deep resources devoted to the bond markets. Over the past several weeks, we participated in over 20 calls with them. We discussed investment strategy and how they are positioning the funds they manage. Many of these firms manage funds held in our clients’ portfolios. Our primary takeaway from these conversations was that despite the Fed’s interventions we are not out of the woods yet. A careful and deliberate approach to selecting bonds is more important than ever. Many of the funds are reviewing their individual holdings one bond at a time to make sure the borrowing entities have adequate resources to weather this storm. Some funds are mitigating risk by buying the same types of bonds the Fed has committed to buy and support. We agree with this approach. This is not the time to throw caution to the wind and we are choosing a more careful and deliberate approach.

Unfortunately, the economy is currently in a free‐fall due to a variety of federal, state and local government mandated shutdowns. Corporate, household and municipal cash flows are going to be under significant pressure that will strain the bond market. We hope that the economic recovery will be quick and V‐shaped, but we suspect it will be more gradual. Authorities will lift social distancing restrictions gradually and at varying speeds for different sectors and regions. Virus infection levels among the global population may wax and wane as will the necessity of reinstating lockdowns to keep the virus under control until a vaccine is developed. Although the economy will start to open up soon, consumers and businesses will likely behave cautiously until a vaccine is available.

Although the timing of a recovery is uncertain, we are confident that better days are ahead. Science and innovation are on our side. Researchers are rushing to repurpose existing drugs and therapies. This will improve recovery rates among the most seriously ill patients and ease the demand on hospitals. There are currently more than 70 vaccine candidates in development around the world. With the entire globe fighting a common enemy and united in its resolve, we will overcome this and economies will rebound. A new cycle will begin. In the interim, we will continue to stay focused on your investments and make adjustments that we believe will be helpful.

As always, please do not hesitate to reach out to any member of our wealth management team if you need anything or want to talk. We very much look forward to the day when we can be together in person.

Douglas B. Phillips, CFA

Douglas B. Phillips, CFA

Chief Investment Officer

douglas.phillips@ledyardbank.com

This communication is intended to be strictly informational. Exclusive of our client relationships, it is not intended to be, nor does it constitute an offer to sell or a solicitation of an offer to buy any securities referenced. Information contained herein has been obtained from sources that are believed to be reliable, but its accuracy and completeness cannot be warranted or guaranteed.

Non-deposit investment products are not insured by the FDIC, are not deposit or other obligations of, or guaranteed by the bank or any affiliate, and are subject to investment risk including the possible loss of principle amount invested.

Ledyard National Bank. All rights reserved.