Spring has finally arrived, and it is rejuvenating to feel the warmth of the sun after the long winter. As the days have grown brighter, so has the investment environment, giving us another reason to be grateful. Remarkably, this year’s stock market performance has been a mirror image of last year’s fourth quarter, when the S&P 500 Index fell nearly 20%, unsympathetically hitting its low on Christmas Eve. Since then, the equity market has rebounded sharply and is now near last October’s all‐time high.

As often happens, the market managed to climb the proverbial wall of worry, surmounting a host of ominous factors. Last year’s concerns included a hawkish Federal Reserve that indicated monetary policy was still “far from neutral,” meaning they would have to raise short‐term interest rates several more times. Escalating trade tensions and uncertainty surrounding what would turn out to be the longest government shutdown in American history added to the uncertainty. Fortunately, just a few days into the New Year, the Fed pivoted, announcing it would take a more patient approach, significantly reducing the likelihood of any rate increases in 2019. Later that month, the government shutdown ended. Recent statements from Washington suggest a trade deal with China is increasingly likely.

I was pleased to learn that only a few of our clients contacted us late last year to ask about reducing their stock exposure in reaction to the market’s sharp decline. That would have involved deviating from the long‐term plans we developed with them based on their goals. Given the strong rebound, it would have also been counterproductive. Congratulations for staying on track! We recognize it is not easy to stay disciplined during such periods of uncertainty. It is unnerving to watch the value of your hard‐earned assets drop among so many gloomy headlines.

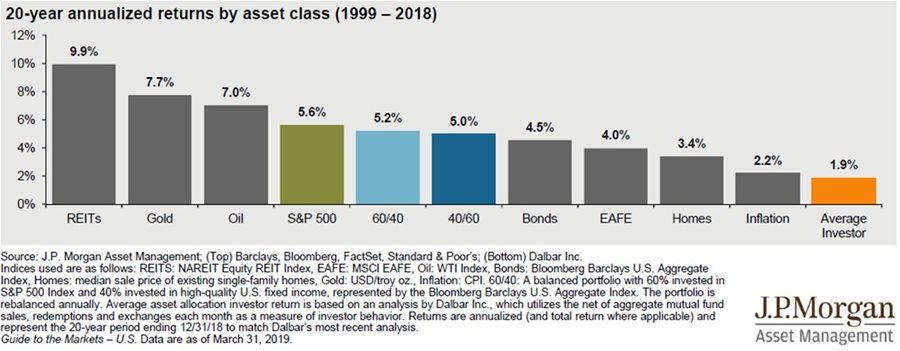

Studies have shown that most other investors struggle to stay disciplined during volatile periods and make decisions that cost them dearly. An organization called Dalbar looked at returns and behavior of individual investors over the twenty‐year period ending in 2018. As shown on the next page, they found the average investor earned an annualized return of only 2% per year during this period. This compared to the average

annual return of 5.2% for a balanced portfolio invested 60% stocks and 40% bonds. They also performed worse than inflation and other types of assets typically held in portfolios. How could investors have performed so poorly? They tended to do all the wrong things at the wrong times for what seemed to be the right reasons. They pulled out of the market only to miss the ride up. They also sold their losing investments to pile into last year’s winners, only to see the fortunes of these investments reverse course in the New Year.

They say that discipline is the bridge between goals and accomplishments and that is clearly the case when investing. We believe the best way to help our clients stay disciplined is through proactive planning that takes their unique financial situation, goals and feelings about risk into account. Determining the right asset allocation, or the mix between stocks, bonds and other assets, is an important part of this process because it is the principal determinant of risk and potential return. As you have noticed, we ask you many questions. We do this to assess your ability and willingness to take risk so that we can help you pick an asset allocation that is right for you. If the fit is right, you will be more comfortable and more likely to stick with the plan even in difficult times.

The best time to fix the roof is when the sky is sunny. The same logic applies to your asset allocation. Now that the market has rebounded, it is a good time to contact us if you have any concerns that your asset mix may no longer be appropriate. This may be because you felt particularly nervous during the recent bout of volatility, or because changes have occurred in your life that may require some portfolio adjustments. We are happy to incorporate assets that you hold outside of Ledyard into our analysis. Many of our clients find this helpful because we sometimes find hidden risks, such as unintended concentrations, or opportunities to enhance your return.

This summer the current economic expansion will enter its eleventh year and become the longest in American history. Fortunately, economic expansions do not perish when they hit some arbitrary expiration date. Instead, they typically end when dangerous excesses develop or because the Federal Reserve raises interest rates too much too fast. Since the financial crisis, economic growth has been weaker than normal. While this has been frustrating to some, slow but steady growth has allowed the economy to avoid the typical boom‐to‐ bust cycle that creates imbalances and leads to recessions. The lack of major imbalances, combined with the fact that the Fed is showing caution on further interest rate increases, suggests that a recession is not yet imminent.

Nevertheless, we recognize that we are likely in the later innings of this cycle. We are also mindful that global economies are slowing and earnings growth expectations have dropped meaningfully. While it is possible that economic growth could pick up later this year on the back of a trade deal, Chinese stimulus and the positive influences of lower interest rates, the likelihood, timing and extent of such impacts are always difficult to predict.

As the economic expansion and bull market grow older, we believe it is important to ensure that our clients hold mostly high quality stocks and bonds. It is also important to rebalance portfolios back to the targets we set with each of our clients to help prepare for the next downturn, whenever it occurs. As I mentioned earlier, we encourage you to contact us to discuss your asset allocation if you believe it may no longer be appropriate. We welcome these opportunities to catch up with you so we can work together to help you stay on track in the future.

Douglas B. Phillips, CFA

Chief Investment Officer

douglas.phillips@ledyardbank.com