At first glance, today’s market seems to leave little room for dividends: the S&P 500’s yield has slipped to just 1.1%, hovering near historic lows as technology and AI-driven companies propel the index to record highs. It’s tempting to dismiss dividends as irrelevant in this environment. Yet history offers a compelling counterpoint – the two times over the last hundred years the S&P 500 yield dropped to 1.25% or lower, dividend growth stocks quietly outperformed, most notably following the aftermath of the Internet bubble, when they outperformed the broader index by more than 100 percentage points over the next seven years.1 In a market increasingly driven by speculation and momentum, dividend growth may be the quiet strength investors need.

At Ledyard, we manage a Dividend Growth strategy designed to provide stability and a growing income stream, ideal for those nearing or in retirement, but increasingly relevant for all investors given today’s elevated valuations and concentrated markets. When reviewing external portfolios, we often find unintended risk exposures. Shifting assets toward dividend growth can restore balance and reduce risk. In this edition of Investment Thoughts, we explain why dividend growth is well-suited to current market conditions and how it can strengthen your portfolio.

Dividend yields fluctuate with market cycles, and today’s low yields reflect rising stock prices rather than falling dividends. Technology firms, now dominant in the U.S. market, typically pay lower dividends. Still, companies that regularly raise dividends tend to have strong balance sheets and disciplined management, making them resilient across market environments.

Dividend growth stocks have consistently raised their payouts over decades, providing investors with a reliable and growing income stream that helps protect against inflation and supports long-term goals. The chart below shows that over the past ten years, a $1 million investment in these stocks saw annual income climb from $24,000 to more than $52,000, an average annual increase of 8%, well ahead of inflation.

Our Dividend Growth strategy yields about 2.4%, low by historical standards but more than double the S&P 500 average of 1.1%. We do not seek the highest yielding stocks, as extreme yields often signal risk - companies may over-distribute earnings, limit reinvestment, and face dividend cuts. These names tend to cluster in mature or challenged sectors and rarely raise payouts, eroding inflation protection over time. Instead, we focus on companies with above-average yields and a consistent record of dividend growth.

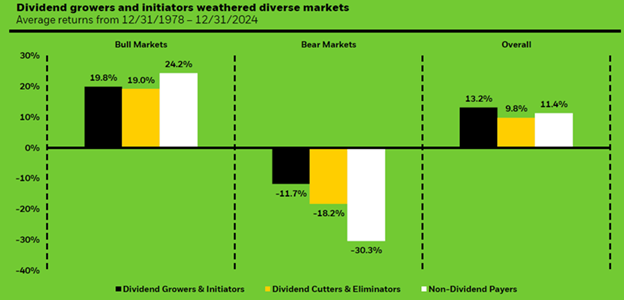

Dividend growth stocks have historically provided lower volatility and better downside protection through market cycles, thanks to consistent payouts and financial strength. As shown in the chart below, while these stocks may lag non-dividend payers during bull markets, they have historically declined less in bear markets and delivered the highest overall returns from 1978 to 2024. This long-term outperformance is notable, given that non-dividend payers are typically seen as more growth oriented.

Blackrock

International stocks make up about 20% of our Dividend Growth equity portfolios, enhancing diversification and opportunity beyond the U.S. They currently yield around 3.3%, triple the S&P 500, and trade at valuations roughly 35% lower than U.S. stocks. 2 These attractive yields and lower valuations provide a margin of safety and reinforce our view that international equities are positioned to outperform over the next 10–15 years. International investing also adds currency diversification, which can enhance returns if the U.S. dollar weakens, as it has in 2025, and adds exposure to sectors less represented in the tech-heavy U.S. market.

The U.S. equity market is historically expensive, with the S&P 500 above the 90th percentile on most valuation metrics. Extreme concentration is a key driver: the top 10 stocks now represent over 40% of index value and have a price-to-earnings ratio that is 40% higher than their 30-year average. Technology and related sectors have nearly doubled their share of the index in a decade, while exposure to defensive sectors has fallen by 40%, reducing the market’s ability to cushion downturns. 3

While we believe artificial intelligence will be transformative, history shows that capital expenditure booms often end in busts when optimism drives overinvestment leading to excess capacity. Investors who overpay and overconcentrate, even in promising technologies, risk significant losses, as seen in past cycles like the Internet/fiber optics crash, housing crisis, and downturns in sectors such as shale, steel, utilities, railroads, and canals. In each case, valuations soared and then collapsed, making it extremely difficult to predict the peak. While timing market inflection points is inherently difficult, maintaining a well-diversified portfolio remains the most effective way to prepare.

Many investors may not realize the rising risks in today’s market, especially in growth and S&P 500 index funds, which are now heavily concentrated in a handful of companies. While we remain strong advocates of indexing and incorporate various types of index funds into our strategies, current conditions call for added caution. Allocating to a Dividend Growth strategy can help reduce risk, enhance diversification, and restore portfolio balance as market leadership narrows and valuations remain high.

Dividend growth investing provides a disciplined approach amid stretched valuations, tech-heavy concentration, and uncertainty. Although no strategy is risk-free, companies with a long history of raising payouts provide meaningful advantages, most notably a steadier path through market cycles.

Please don’t hesitate to reach out to either of us if you have questions or would like us to review a portfolio to see how our Dividend Growth strategy might help.

Douglas B. Phillips, CFA

Senior Vice President & Chief Investment Officer

Office Phone: 603.640.2726

douglas.phillips@ledyard.bank

Thomas Hudson, CFA

Senior Vice President & Investment Strategist

Office Phone: 603.513.4091

thomas.hudson@ledyard.bank